Housing market forecast for 2023

The fortunes of the housing market are inexorably linked with the wider economy. Inevitably then, the current 'perfect storm' of rising interest rates and a cost of living crisis, coupled with stalling wages has really put the brakes on. Fewer and less affordable mortgages = less buyers. So, while there remains a good number of homes on the market, there are a lot less buyers around – particularly first-time buyers, the lifeblood of a buoyant market.

So, against this backdrop, what has been the impact of the economic slump thus far, and what can we reasonably expect from the year ahead? These are the two big questions I'll answer here…

UK market overall – now and next year

Without the benefit of a crystal ball, it is tough to make confident predictions about the year ahead. Even the country’s leading economists are struggling to agree on how long or how deep a recession we are in for! Nor can anyone know exactly to what extent the current slump will impact on peoples’ desire or ability to buy or sell their homes.

That was a quite lengthy but necessary caveat. But I do have a view on things, which is based on reading and listening (lots!) to what reliable industry authorities and insiders are saying, and also on what I’ve experienced first-hand when working through previous challenging markets in the years following 2009.

Where we are now

The first signs of the market beginning to cool were apparent as early as the end of April. The phone wasn't ringing off the hook anymore, buyers were becoming fussier and their was an increase in cancelled or rearranged viewings. While this might not seem much to go on, it was a noticeable change in the wind. Buyers that had previously been desperate to be first through the door for new instructions, and would drop everything to view at any time/day of the week.

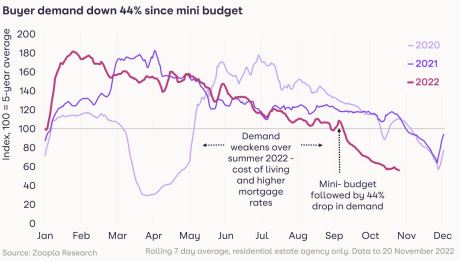

The cost of living and interest rate hikes were taking effect. September brought us a new Monarch, new Prime Minister and a new cabinet. The infamous mini-budget was announced on 23rd September and immediately after, the city markets plummeted. The property market followed suit, as the impact on the markets flowed through to cost of mortgages. Hometrack released this graph below, which shows just how detrimental the mini-budget was to the property market.

But it is worth putting these figures into context. Keep in mind that in 2022 to-date, there has still been an average increase in property prices of 10.7% (source = Office for Budget Responsibility). That is despite the recent market slowdown!

What will 2023 hold?

Looking ahead to 2023, it is clear there will be a ‘re-setting’ of prices. But I believe any suggestion of a housing market crash to be rather sensationalist and not really grounded in reality or historical precedent.

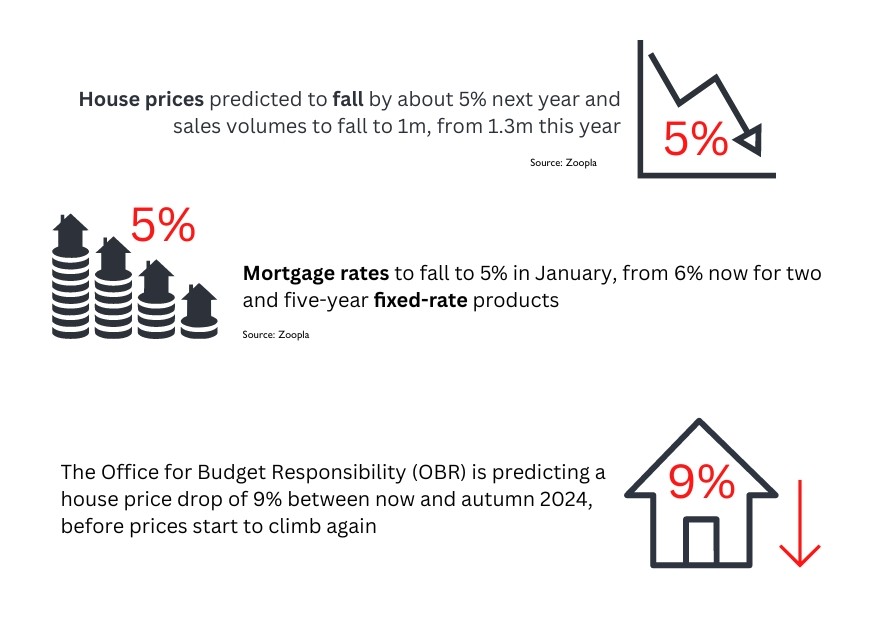

Here are some of the most notable predictions made about the UK housing marketing in 2023:

Richard Donnell, executive director at Zoopla, said: “The housing market is adjusting to a reset in the level of mortgage rates… While the outlook for house prices is weak, we see a shift to more needs-driven motivations to move in 2023 and beyond which will support sales volumes.”

Local Camberley property market

Zoopla’s research suggests the asking price reductions mentioned earlier in this article are greatest in southern England, where sales volumes have fallen furthest. So, what else can we learn from sales and price data?

But it isn’t all doom and gloom. While prices locally, as with the UK as a whole, will inevitably come down next year from their historical highs, this change will likely be relative for you if you are selling AND buying.

Also, expect factors such as increased job market flexibility, retirement or relocation plans to continue to encourage moves – as they have been since the pandemic.

Anecdotally, roughly 32% of applicants I’ve had for our property listings this year have been people based within the M25 and looking to move further out to get more for their budget. This is a trend I fully expect to continue – which is obviously positive news for towns like Camberley.

Conclusion

There are still buyers around and it is still possible to secure the price you want for your home. To achieve that though, you must get your pricing, promotion and presentation right. This is key to attracting the best buyers to your property over and above others on the market vying for their attention.

If you are planning a move, and are keen to get any advice, I’d be very happy to help.

Lucy Egan | Managing Director